We’ve used Tech Nation’s Data Commons service to narrow down the most successful startups in London, and this week it’s the turn of mobile app-focused companies.

As a business model, apps are lucrative and popular, but highly competitive.

An app can be a hit one day and forgotten the next – so its up to creators and designers to keep the UX fresh and the service invaluable.

They cover the widest possible range of sectors – whether that’s banking, entertainment, shopping, or much more.

And a number of London’s very own have succeeded in becoming renowned and trusted the world over.

Let’s look at the top 10 most successful startups using apps this week:

1. Monzo

Successfully and rapidly having changed the nature of banking in Britain, Monzo is a FinTech unicorn that lets you manage your money directly from your phone.

The mobile-only bank is now used across the UK, and has plans to launch in the US.

Founded: 2015

Value: £2 billion

2. Curve

Curve lets users add their credit and debit cards to one smart card and app.

By linking all your accounts in one, it means you only need to carry one card, and helps with budgeting too.

Founded: 2015

Value: At least £194 million ($250 million)

3. Soldo

Mobile business account provider Soldo lets you take control of company spending.

The prepaid card does your expenses for you – offering customisable budgets, access limits, and a user-friendly app.

Founded: 2014

Value: At least £186 million (€216 million)

4. Zego

Shoreditch-based Zego aims to simplify insurance for small providers – with flexible motor, professional and commercial insurance options.

Drivers and riders working with providers like Deliveroo and Uber can get quick and tailored cover for their work, for time-frames as short as one hour.

Founded: 2016

Value: At least £130 million ($168 million)

5. Callsign

Callsign is an identity fraud, authorization and authentication company, helping organisations like banks reduce fraud and boost user experience.

Founded: 2011

Value: At least £115 million ($148 million)

6. Jaja

Finance Jaja aims to simplify credit.

They’ve created a credit card service that’s digital and mobile-first – with added features and benefits for users.

Founded: 2016

Value: At least £80 million

7. Duffel

Appearing in Prolific London’s Top 10 Travel startups, Duffel is promising big – saying they’re “Creating the future of travel” – but staying quiet for now on just how.

Founded: 2017

Value: At least £66 million ($86 million)

8. Azimo

Azimo works with partners in nearly 200 countries to provide fast, safe money transfers.

It offers both personal and business options, allowing for simpler transferring of funds around the world.

Founded: 2012

Value: At least £62 million ($80 million)

9. Touch Surgery

Touch Surgery is augmenting training in surgery.

It lets people train, prep and test themselves on procedures wherever they are.

Founded: 2013

Value: At least £60 million

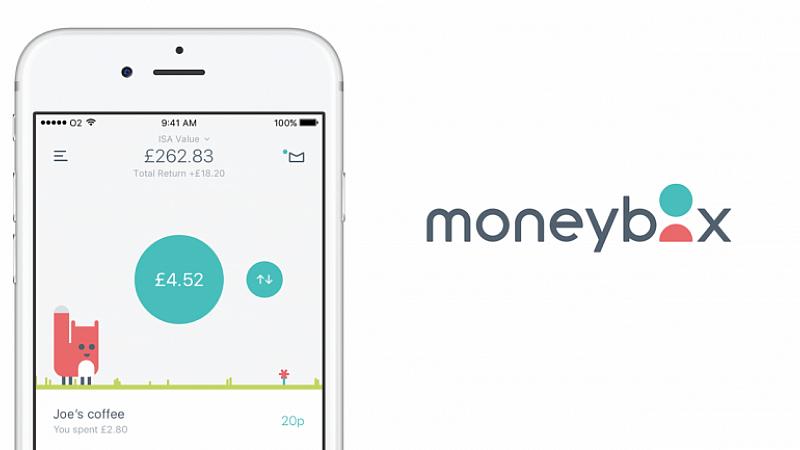

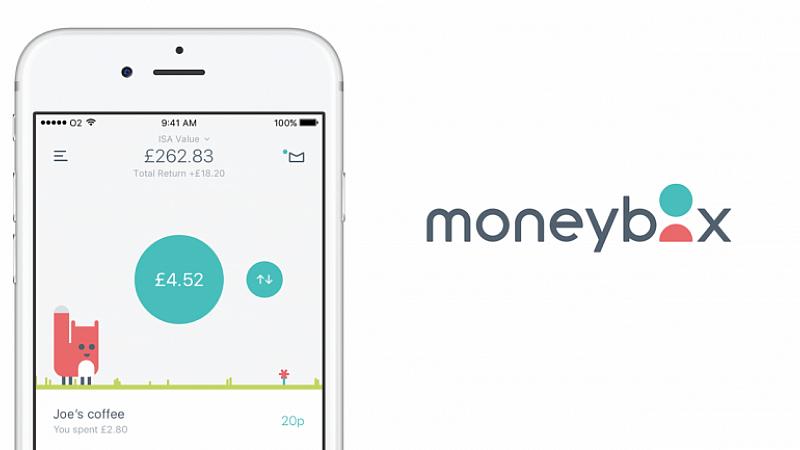

10. Moneybox

Round up your purchases to the nearest pound and set aside the spare change with Moneybox, which promises to be the simplest way to save and invest.

Founded: 2015

Value: At least £56 million