Chip, the London-based AI-powered app that helps you save money, has announced it’s raising a total of £7.3 million, with £3.8 million crowdfunded by Chip’s customers, and the remainder from angel investors.

Industry veterans

The company has also brought in a number of industry veterans and experts to help drive Chip’s growth.

Last year, Chip broke UK crowdfunding records, raising around £4 million by the time it closed and earning the title of the largest crowdfund the UK had ever seen at the time.

This year, the company welcomed thousands more investors, bringing the total number to over 10,000.

The company opted to initially offer £1 million to existing investors, and after funding exceeded £1 million in just 54 minutes, Chip opened up the remaining allocation to their customers.

Chip’s 2019 crowdfunding campaign ran for three weeks in September and is currently Crowdcube’s most participated-in crowdfund ever, with 7,182 investors.

Scaling and capacity

The capital will go towards scaling and improving Chip’s capacity to handle large volumes of customers, by both expanding the team and refining infrastructure.

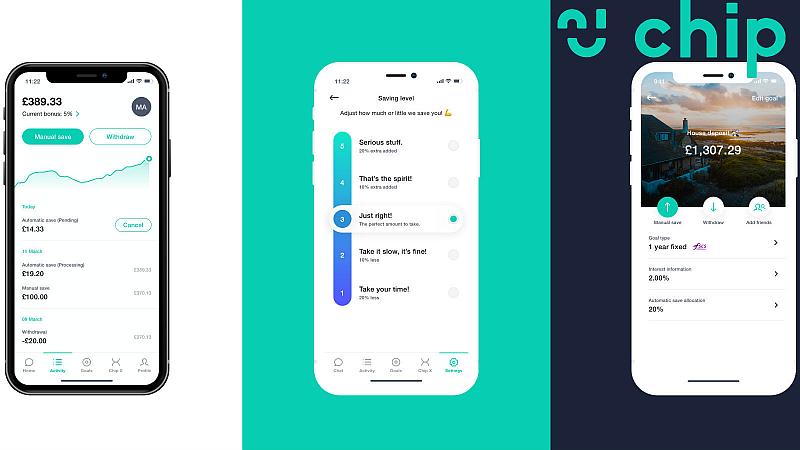

The company also plans on using the funds to launch market-leading savings rates, offer access to FSCS protected accounts, and deliver an in-app marketplace for returns products.

Chip’s goal is seamless access to market-leading products in one, easy-to-use app.

The investment comes after a fantastic year where Chip said it more than doubled the value of the business, massively grew the company’s accounts to over 150,000 and also welcomed experienced hands to the leadership team.

Fintech alumni joining the firm include David Kavanagh (CTO), former CTO of Purplebricks; Sharon Miles (COO), former Innovation Director of a B2B fintech unicorn Deposit Solutions, as well as Barclays and LeasePlan; Gerard Hurley (CCO), former compliance lead at Funding Circle, as well as an ex FCA regulator; and Gary Dolman (Board Advisor), Co-Founder of Monzo and recently retired from CFO role.

“The most powerful way for Chip to grow is to have thousands of investors advocating for the product they believe in”, said Simon Rabin, CEO of Chip.

“It’s amazing to have this many Chip savers as investors in the company.

We’ve proven there’s a big demand for Chip, and we’re ready to scale – we’re going to use our investment to grow and deliver a product that will fill a huge gap in the market.

“Many of the other big names in fintech are focussed on making spending easier. Monzo has the current account, Curve is disrupting credit cards, and Revolut has the travel card, but Chip… Chip is for saving.”

David Kavanagh, CTO of Chip, added: “The savings market is archaic, broken and ineffective. People want more from their savings accounts, so they are voting with their capital.

“Chip has raised VC-levels of funding from its users and supporters, demonstrating that what customers want is a market-changing product that is easy to use, helps them save, and offers the best possible rates in the market.

“It’s an incredibly exciting time for the company and I’m delighted to have joined it as such a pivotal stage. I look forward to working with the team at Chip to help set a new standard for savings apps.”